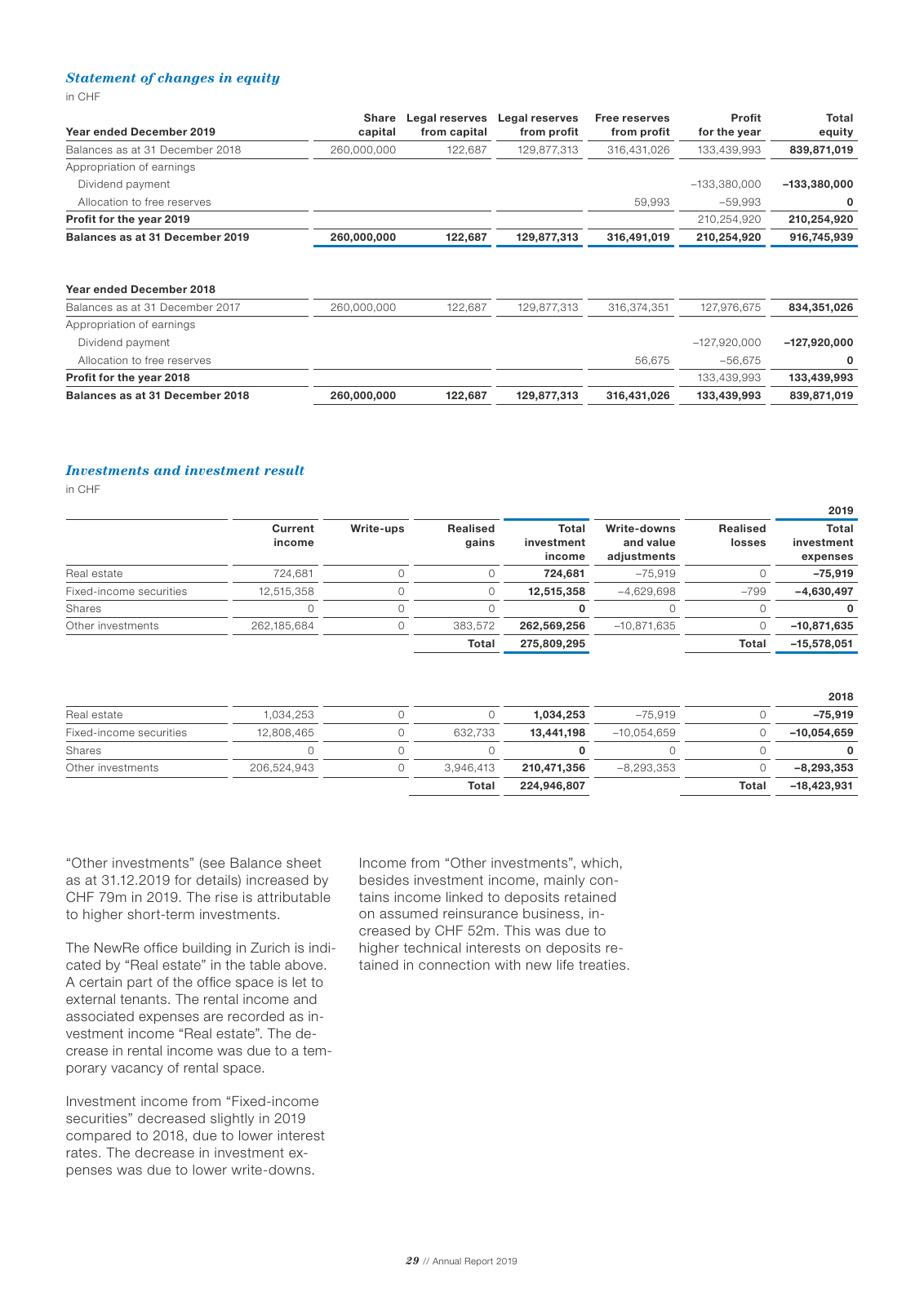

29 Annual Report 2019 Statement of changes in equity in CHF Year ended December 2019 Share capital Legal reserves from capital Legal reserves from profit Free reserves from profit Profit for the year Total equity Balances as at 31 December 2018 260 000 000 122 687 129 877 313 316 431 026 133 439 993 839 871 019 Appropriation of earnings Dividend payment 133 380 000 133 380 000 Allocation to free reserves 59 993 59 993 0 Profit for the year 2019 210 254 920 210 254 920 Balances as at 31 December 2019 260 000 000 122 687 129 877 313 316 491 019 210 254 920 916 745 939 Year ended December 2018 Balances as at 31 December 2017 260 000 000 122 687 129 877 313 316 374 351 127 976 675 834 351 026 Appropriation of earnings Dividend payment 127 920 000 127 920 000 Allocation to free reserves 56 675 56 675 0 Profit for the year 2018 133 439 993 133 439 993 Balances as at 31 December 2018 260 000 000 122 687 129 877 313 316 431 026 133 439 993 839 871 019 Investments and investment result in CHF 2019 Current income Write ups Realised gains Total investment income Write downs and value adjustments Realised losses Total investment expenses Real estate 724 681 0 0 724 681 75 919 0 75 919 Fixed income securities 12 515 358 0 0 12 515 358 4 629 698 799 4 630 497 Shares 0 0 0 0 0 0 0 Other investments 262 185 684 0 383 572 262 569 256 10 871 635 0 10 871 635 Total 275 809 295 Total 15 578 051 2018 Real estate 1 034 253 0 0 1 034 253 75 919 0 75 919 Fixed income securities 12 808 465 0 632 733 13 441 198 10 054 659 0 10 054 659 Shares 0 0 0 0 0 0 0 Other investments 206 524 943 0 3 946 413 210 471 356 8 293 353 0 8 293 353 Total 224 946 807 Total 18 423 931 Other investments see Balance sheet as at 31 12 2019 for details increased by CHF 79m in 2019 The rise is attributable to higher short term investments The NewRe office building in Zurich is indi cated by Real estate in the table above A certain part of the office space is let to external tenants The rental income and associated expenses are recorded as in vestment income Real estate The de crease in rental income was due to a tem porary vacancy of rental space Investment income from Fixed income securities decreased slightly in 2019 compared to 2018 due to lower interest rates The decrease in investment ex penses was due to lower write downs Income from Other investments which besides investment income mainly con tains income linked to deposits retained on assumed reinsurance business in creased by CHF 52m This was due to higher technical interests on deposits re tained in connection with new life treaties NewRe AnnualReport 2019 Korrekt indd 29 27 04 20 09 43

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.