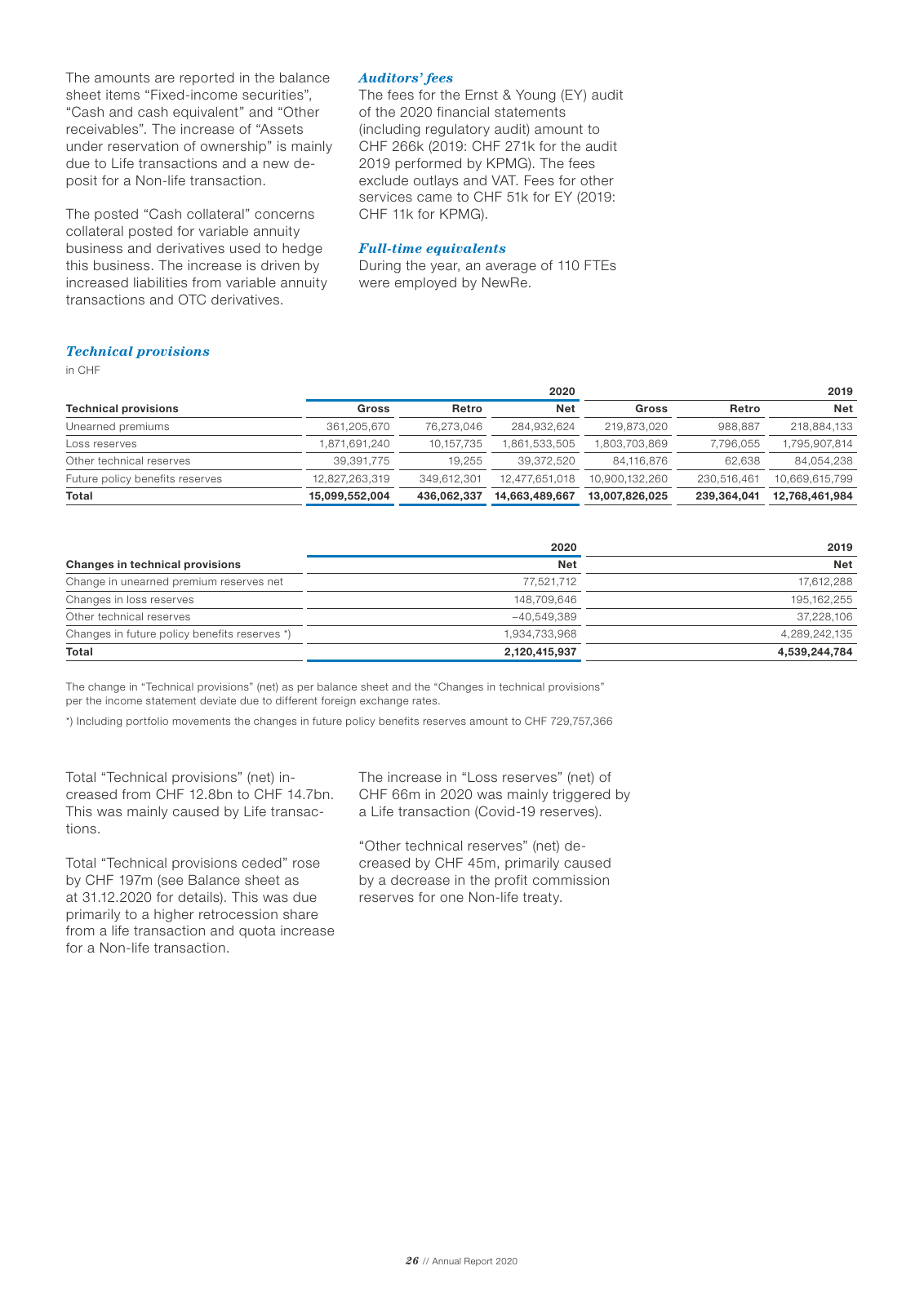

26 Annual Report 2020 The amounts are reported in the balance sheet items Fixed income securities Cash and cash equivalent and Other receivables The increase of Assets under reservation of ownership is mainly due to Life transactions and a new de posit for a Non life transaction The posted Cash collateral concerns collateral posted for variable annuity business and derivatives used to hedge this business The increase is driven by increased liabilities from variable annuity transactions and OTC derivatives Auditors fees The fees for the Ernst Young EY audit of the 2020 financial statements including regulatory audit amount to CHF 266k 2019 CHF 271k for the audit 2019 performed by KPMG The fees exclude outlays and VAT Fees for other services came to CHF 51k for EY 2019 CHF 11k for KPMG Full time equivalents During the year an average of 110 FTEs were employed by NewRe Technical provisions in CHF 2020 2019 Technical provisions Gross Retro Net Gross Retro Net Unearned premiums 361 205 670 76 273 046 284 932 624 219 873 020 988 887 218 884 133 Loss reserves 1 871 691 240 10 157 735 1 861 533 505 1 803 703 869 7 796 055 1 795 907 814 Other technical reserves 39 391 775 19 255 39 372 520 84 116 876 62 638 84 054 238 Future policy benefits reserves 12 827 263 319 349 612 301 12 477 651 018 10 900 132 260 230 516 461 10 669 615 799 Total 15 099 552 004 436 062 337 14 663 489 667 13 007 826 025 239 364 041 12 768 461 984 2020 2019 Changes in technical provisions Net Net Change in unearned premium reserves net 77 521 712 17 612 288 Changes in loss reserves 148 709 646 195 162 255 Other technical reserves 40 549 389 37 228 106 Changes in future policy benefits reserves 1 934 733 968 4 289 242 135 Total 2 120 415 937 4 539 244 784 The change in Technical provisions net as per balance sheet and the Changes in technical provisions per the income statement deviate due to different foreign exchange rates Including portfolio movements the changes in future policy benefits reserves amount to CHF 729 757 366 Total Technical provisions net in creased from CHF 12 8bn to CHF 14 7bn This was mainly caused by Life transac tions Total Technical provisions ceded rose by CHF 197m see Balance sheet as at 31 12 2020 for details This was due primarily to a higher retrocession share from a life transaction and quota increase for a Non life transaction The increase in Loss reserves net of CHF 66m in 2020 was mainly triggered by a Life transaction Covid 19 reserves Other technical reserves net de creased by CHF 45m primarily caused by a decrease in the profit commission reserves for one Non life treaty NewRe AnnualReport 2020 indd 26 28 04 21 19 06

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.